Loading.....

Fintech Industry Game-Changing Trends of 2024

In the dynamic landscape of finance, the relentless march of technology has birthed a new era of unprecedented efficiency and innovation. The integration of advanced technological solutions has revolutionized the financial sector, offering a myriad of benefits that resonate with both financial professionals and consumers alike. This exploration delves into the captivating realm of technology-driven transformations, examining the profound impact on efficiency, security, real-time decision-making, customer experience, and global accessibility within the financial sphere.

Benefits of Technology Advancement in Finance

- Efficiency and Automation: Technology has ushered in an era of unprecedented efficiency and automation in financial operations. Tasks that once consumed considerable time and resources are now executed swiftly and accurately through automated systems. This not only reduces the likelihood of human errors but also allows financial professionals to focus on strategic decision-making rather than mundane tasks.

- Enhanced Security Measures: As financial transactions become increasingly digital, security is a paramount concern. Technology has responded to this challenge by introducing robust security measures such as encryption, biometric authentication, and advanced fraud detection algorithms. These measures not only safeguard sensitive financial information but also instil confidence in users, fostering a secure financial environment.

-

Real-time Data and Analytics: Accessing real-time data is a pivotal advantage of technological advancement in finance. Financial institutions can now make informed decisions promptly, reacting to market changes and customer needs in real time. Analytics tools enable detailed insights into customer behaviour, investment trends, and risk assessment, empowering financial professionals to make data-driven decisions for optimal outcomes.

- Improved Customer Experience: Technology has redefined the way customers interact with financial services. Online banking, mobile apps, and digital wallets offer unparalleled convenience, allowing users to manage their finances anytime, anywhere. Chatbots and virtual assistants further enhance customer experience by providing instant support and personalized recommendations, fostering stronger relationships between financial institutions and their clients.

- Global Accessibility: Technology has eliminated geographical barriers in the financial world. With online banking and digital transactions, individuals and businesses can seamlessly conduct financial operations across borders. This global accessibility not only facilitates international trade but also opens up new opportunities for investment and collaboration on a global scale.

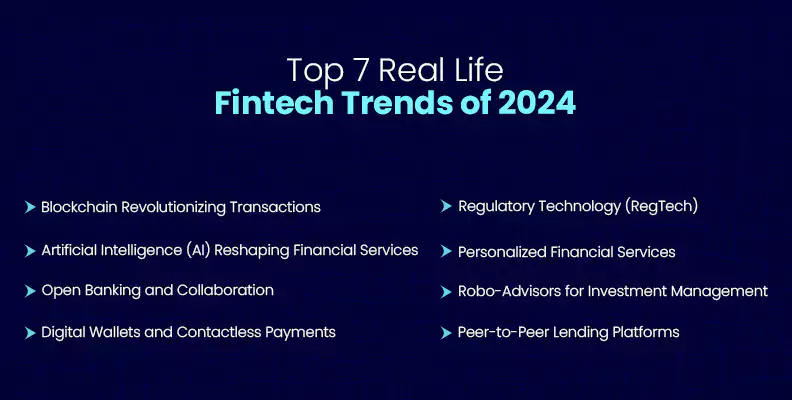

Top 7 Real Life Fintech Trends of 2024

-

Blockchain Revolutionizing Transactions

Cryptocurrencies, led by the pioneering Bitcoin, have disrupted traditional finance models. Blockchain technology, the backbone of cryptocurrencies, ensures secure, transparent, and decentralized transactions. Companies like Coinbase have emerged as leaders in providing cryptocurrency exchange platforms, allowing users to buy, sell, and trade digital assets with ease.

-

Artificial Intelligence (AI) Reshaping Financial Services

AI is at the forefront of Fintech innovation, offering smarter and more efficient solutions. Machine learning algorithms are being employed to analyze vast datasets, enhance fraud detection, and personalize customer experiences. Robo-advisors are leveraging AI to provide automated, data-driven investment advice, democratizing access to wealth management services.

-

Open Banking and Collaboration

Open Banking is fostering collaboration between traditional financial institutions and new-age Fintech startups. APIs (Application Programming Interfaces) are enabling seamless data sharing and integration of services, allowing customers to enjoy a more comprehensive and personalized financial experience. This collaborative approach breaks down traditional barriers, promotes competition, and drives innovation.

-

Digital Wallets and Contactless Payments

The rise of digital wallets and contactless payments is transforming the way consumers manage their finances. Fintech companies are offering user-friendly mobile applications that enable secure and convenient transactions. With the increasing adoption of smartphones, digital wallets are becoming an integral part of the everyday financial ecosystem. Fintech giants like PayPal, Square, and Stripe have empowered users to make seamless, secure, and instant payments using their smartphones.

-

Regulatory Technology (RegTech)

As the Fintech industry evolves, so do regulatory requirements. Regulatory technology, or Regtech, platforms like ComplyAdvantage have streamlined compliance processes, enhanced risk management, and ensured adherence to regulatory standards. Automated reporting, identity verification, and fraud prevention are areas where RegTech is making significant contributions.

-

Personalized Financial Services

Fintech is moving towards hyper-personalization, tailoring financial products and services to individual customer needs. Data analytics and AI algorithms are helping companies understand customer preferences, behaviour, and risk profiles. This enables the delivery of customized solutions, ranging from insurance products to investment strategies.

-

Robo-Advisors for Investment Management

Fintech has democratized investment opportunities with the rise of robo-advisors. Platforms like Wealthfront and Betterment leverage algorithms to provide personalized investment advice and portfolio management. This not only reduces the barrier to entry for investors but also optimizes portfolio performance through data-driven decision-making.

-

Peer-to-Peer Lending Platforms

Traditional lending models have faced disruption through peer-to-peer lending platforms such as LendingClub and Prosper. Fintech enables individuals and small businesses to access loans without the intermediaries of traditional banks. This not only broadens access to credit but also creates a more inclusive financial ecosystem.

Conclusion

In a world where financial evolution is synonymous with technological progression, the benefits reaped from this synergy are unmistakably transformative. As we navigate the intricate realm of finance, the trailblazing advancements discussed here underscore a paradigm shift—one that transcends traditional boundaries and propels the financial sector into a future defined by efficiency, security, real-time insights, enhanced customer experiences, and global interconnectedness.

As we gaze into the horizon of fintech trends, it becomes evident that the metamorphosis is far from over. Embracing these trends not only ensures resilience but positions individuals and institutions at the forefront of an ever-evolving financial landscape, where the fusion of finance and technology continues to be the catalyst for progress.

Back to blog

Back to blog